04 Jan 4 Growth Alternatives to CD or Money in the Bank

Recently, a client asked me the following question, “I have money sitting in the bank not earning any interest, is there something else I could do with it besides put it in a CD”? I’m asked this question all too often! In today’s low CD interest rate environment and uncertain stock market, where can you put your cash that’s safe, liquid and can generate some growth?

In this article, I’ll share with you four growth alternative investments to having your money in the bank or in a CD. You’ll also see that this is the way that Wall Street invests and why it will also work for you!

With bank CD rates near 1% and saving accounts not earning much interest my client’s question is timely and smart. To find out exactly how to best serve my client, I had to ask some questions. How much did they want to invest? When did they need the money? What rate were they expecting? I soon discovered that they wanted the money in safer investments, they wouldn’t need the money for five years and they wanted a better return than what the banks were offering.

Based on the client’s goals, we came up with four alternative wealth accumulation strategies to having money in savings account or in a CD:

- Fixed 3: This Fixed 3 program functions very much like a CD with tax deferred advantages. You put your money in for five years with a financial institution. This institution guarantees your money and provides 3% interest per year. After the five year commitment, you walk away with your initial deposit and the interest payments. (1)

- Corporate Bond: The second option I proposed was a purchase of an investment grade corporate bond. With a corporate bond the investor basically provides a loan to the corporation while the corporation promises to make interest payments to the investor. At the end of the term (or in 5 years for this particular bond) the investor would get their principal back. Currently, the five-year U.S. corporate BBB bond rates are between 3.5% to 4.5% per year. You can see current bond rates here. (2)

- Index 5: The third option is a five-year indexed wealth accumulation program, that has downside protection (so you don’t lose any money) and participates in upside index potential. Based on historical returns, the client can expect to earn about 5.08% annually. (3)

- Preferred Stock: Some corporations issue preferred stock. A preferred stock is somewhat of a combination of bonds and common stock. Preferred stocks are attractive because they have coupon rates or interest rates that are paid on a regular basis. Preferred stock holders have a higher priority over common stock holders and dividends are paid to shareholders. The negative, is that it trades like a stock and the price of the preferred stock can be lower in five years. Some of the more attractive preferred stocks we suggested offer an interest range between 4% to 5.75%.

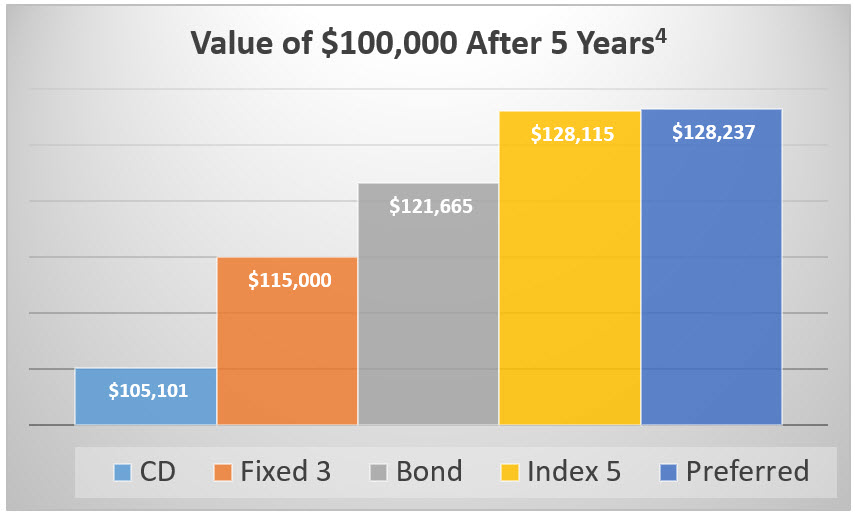

After presenting the client with these options; they asked me how much their $100,000 would be worth after five years? We put this chart together to illustrate the value of $100,000 after five years.

If you started with $100,000, after five years a CD earning 1% per year would be worth a little more than $105,000. The Fixed 3 would be worth $115,000. The US Corporate bond would be worth around $121,000. Lastly, the Index 5 and Preferred stock (which are not guaranteed and are projections) would be worth around $128,000.

After going through this exercise, the client was convinced that these alternatives would potentially put over $20,000 of additional money in their pocket while still having safety and the liquidity they needed.

Most average investors are not aware of these alternatives. Do you think the banks and financial institutions allocate most of their savings to earn 1%? Probably not. So, why should you? Why not invest like the banks and financial institutions and keep more of what you make?

If you have money sitting in the bank earning a low interest rate and want higher returns, please take a visit our Xceed Solutions page or contact us.

_____________________

(1) 3% is the current rate and rates are subject to change

(2) Source: TD Ameritrade Institutional Fixed Income. Based on a five year, US Corporate BBB Effective Yield as of 1/2017

(3) https://madindex.bnpparibas.com/Index#performance-tables

(4) Assumes a CD rate of 1.0%. Fixed 3 assumes a rate of 3% simple interest annually. Bond rate assumption is an average bond rate of 4.0%. Index 5, is a projected number based on historical returns of 5.08%. The preferred stock yield assumption of 5.10%