29 Nov Misleading Stock Market Results, How to Solve the Biggest Investment Mistake

When we listen to the financial media and financial professionals, they repeat the same old stories decade after decade. Common mantras like: “buy and hold is safe”, “the market always comes back,” or “you haven’t lost until you sell,” and “invest as much money as you can in the stock market as soon as you can.” These are just a few examples of what you hear from the financial industry and the experts who are consistently promoting the services they sell to you. Is this really the right way to invest? We’re going to dive into one of these mantras, the “buy and hold” strategy, and you’ll be shocked at what you read.

Let’s begin with a simple question: Would you invest in a vehicle with only a 3.0% annualized return and your money is also at risk of losses? Think about that for a minute. You have the risk of potentially losing money, compounded with the fact that this vehicle over the last decade and a half, has produced an annualized return of only 3.0%. Would you put your hard-earned savings into an investment plan that works like this? Most people I’ve talked to have replied with a resounding ‘no’. Let’s take a look.

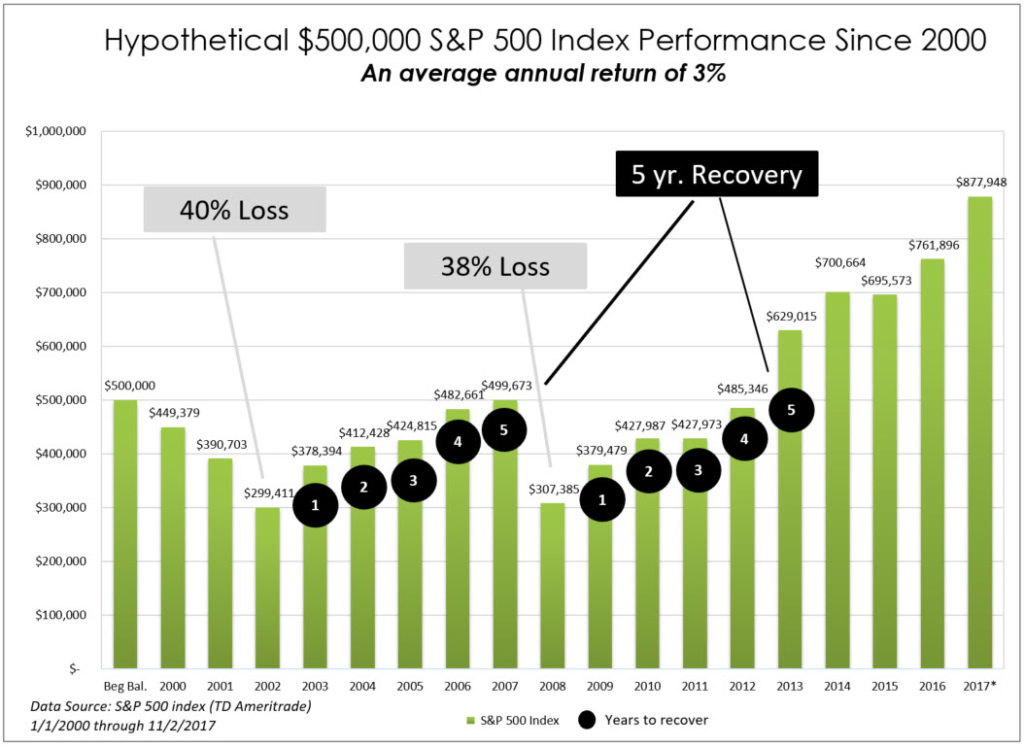

The chart above is a hypothetical $500,000 investment in the S&P 500 Index since 20001. For this example, let’s assume that all of your money was invested in the stock market.

In 2000, with starting balance of $500,000 in your portfolio, you would have taken a substantial hit due to the multi-year market decline. Your savings would have dropped about 40% and your portfolio would now be worth $300,000. If you had the courage to stay in the market, you spent the next five years crawling back to nearly breakeven in 2007.

Then the financial crisis of 2008 hit and your portfolio dropped another 38%. Again, it took about five years to get back to your original $500,000 portfolio balance…another five years wasted playing catch up.

Take a good look at the chart above. How much have you earned from 2000 to 2012 with the “buy and hold strategy”? Nothing.

Since 2000, profits have only been made in the last few years. In this example, our $500,000 beginning balance has grown to $877,000 as of November 2017. That’s a shocking average annual rate of return of 3.0%. Is an investment return that is at par with long-term CD rates really worth the risk? Did the buy and hold strategy really work over this period of time?

These investment strategies are promoted by Wall Street, mutual fund companies, and many other financial institutions every day. What the financial industry may not be telling you is that every time you lose money in the markets, you create a drag on your account and your portfolio is constantly working to get back to breakeven. This drag can stay with you for 5 to 10 plus years.

Is this truly the best that Wall Street and other financial institutions have to offer? More importantly, has it given you the confidence you need to retire comfortably and live the life you want to live? Is this really the right approach for investing or is there a better way?

The problem with “buy and hold” is that investors never hear the full title of that strategy. This is probably why people don’t understand the major flaw until it’s too late when the money is gone and the years are wasted. The full title of the strategy is “buy at any price in the market and hold with no plan for risk or profit.” Does this make any sense to you? Do you think this is the strategy financial institutions use for their own capital? I know we’re not making any friends on Wall Street writing articles like this, but we feel that it’s our responsibility to expose the truth. Furthermore, the problem is not the big banks and financial institutions, the problem is the investor. Wall Street isn’t doing anything wrong, the average investor making mistakes simply due to a lack of understanding. To really change your financial trajectory, there is only one solution: stop thinking and acting like an average investor and start thinking and acting like the big banks and financial institutions.

We’ve been in the financial industry long enough to know that the actions of the average investor compared to Wall Street’s actions are usually the exact opposite. This is why one group typically achieves record breaking profits and the other group hardly ever comes close to achieving their financial goals. What if you start thinking and acting like Wall Street and other financial institutions? Let’s take the first step here and see where this leads you.

What if you had access to an investment strategy that is designed to participate in stock market gains while also providing stability during periods when the stock market has had significant negative returns? That’s exactly what we’ve created.

We spent years developing a very low risk, wealth-building and passive income strategy. We call it the Xceed Steady Growth Strategy.2 The strategy utilizes a multi-faceted methodology that leverages income payments which are then used to enter positions in the stock market. In other words, you’re able to take advantage of stock market gains without stock market risk to your principal. Many investors are surprised to hear this is not an annuity.

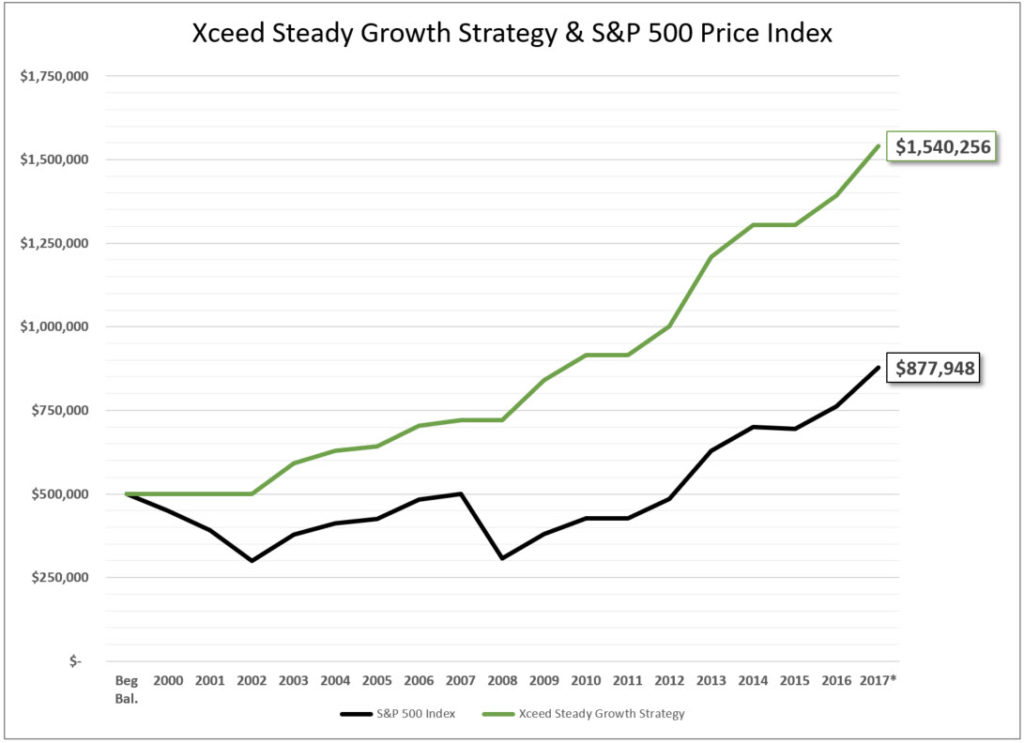

Let’s compare the Xceed Steady Growth Strategy and the S&P 500 Index over this same period. The Xceed Steady Growth Strategy participates in 70% of the stock market gains and stays steady when the stock market is negative.

Look at the chart below. Starting with an account value of $500,000, the Xceed Steady Growth Strategy would have an account value of $1.5 million compared to the S&P 500 Index account value of $877,984. That’s a $660,000 increase to your account over the same period.

From 1/1/2000 to 11/2/2017. Note: hypothetical data does not take index fees or transaction costs into account.

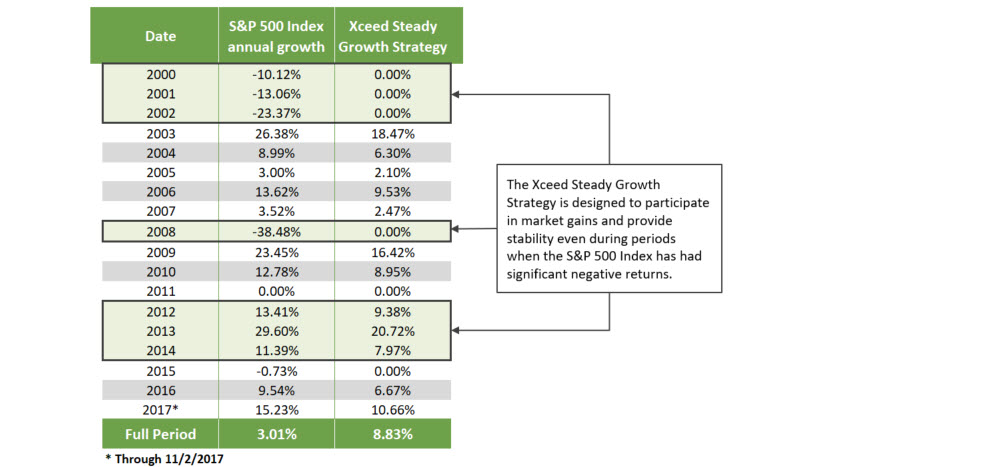

The table below table below illustrates a side-by-side comparison between the Xceed Steady Growth Strategy and the ‘buy and hold’ strategy in the S&P 500 Index. In the early 2000’s when the S&P 500 Index had three consecutive years of losses, the Xceed Steady Growth Strategy is designed to keep your investments steady.

2012 through 2014 when the S&P 500 Index had positive gains, the Xceed Steady Growth Strategy is designed to participate in those gains (70% of those gains in this example).

The path to living the life you want starts with financial decisions that support your life goals and priorities. Before we make any suggestions about your investments, we take the time to understand what’s important to you. Having a personal Xceed Life Plan™ will give you confidence and control over your choices, rather than the financial markets making those life choices for you.

Do you have the money you need to live the live you choose to live? Don’t let the markets determine your qualify of life; take control of your investments. Contact us for a complimentary portfolio risk and fee assessment. We look forward to helping you build your own personal Xceed Life Plan™.

—————

1 S&P 500 index (source TD Ameritrade) from January 1, 2000 through November 2, 2017

2 Xceed Steady Growth Strategy: a return of 0.0% when the S&P 500 Price Index is negative and 70% of the S&P 500 Price Index when it’s positive.