08 Nov Mutual Fund Mistakes You Need to Avoid

Mutual Fund and Investment Fees Can Be Costly:

Most often, mutual fund and investment companies are very secretive about the cost of their services and hide the cost of investments. One of the biggest challenges for investors is that most don’t understand, or are even aware of, the hidden cost of investing. In this article, we’ll share with you the mutual fund and investment costs to look for, what those fees mean and how much they are potentially costing you. We help investors find and eliminate hidden mutual fund and investment fees so you can put more money in your pocket.

We hear it quite often from potential investors: “The stock market keeps going up but my portfolio isn’t increasing as much as it should, why?” In most cases, the answer lies in the cost of investing that investors aren’t aware of. According to a study published by Demos (a public policy organization), the average investor household will spend one to two years working just to cover 401(k) fees and associated costs.

Here is the secret to what you need to look for:

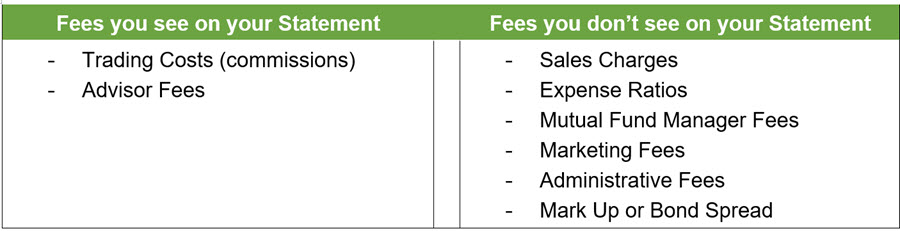

There are fees you see on your investment statement, and fees you don’t see on your investment statement. The key is to identify these fees, and if you can, find ways to reduce or eliminate them.

Below is an example of the different types of fees that the financial institutions charge you to make their money. These fees include; sales charges, commissions, expense ratios, mutual fund manager fees, marketing fees, administrative fees, mark ups, bonds spreads and advisor fees.

Okay we get it, there are a lot of ways the financial institutions can make money on you. You see, the scary part is that most investors are not aware of most of these fees. After we spend a little time with our clients, they’re shocked at what we uncover. They’re surprised that out of all the investment fees below, only the two on the left are on their investment statement. The other fees on the right are hidden, and don’t show up on their investment statement. Do you think this has anything to do with why their investments are not increasing as much as they should?

Here are some definitions around these investment fees and costs to help you understand how to avoid or eliminate them:

- Sales Charges: mostly found in high cost mutual funds, a one-time sales charge front end load (the fee you must pay when you purchase the mutual fund) or sometimes the fund might have a back end load (the fee you pay to get out of the fund). These fees can range anywhere from 0.50% to 5.75%.

- Expense Ratios: this is a fixed fee, the cost the mutual fund investment company charges to operate the fund. The range can be anywhere from .05% to 1.25%, charged annually for mutual funds and ETF’s.

- Fund Management Fees: salaries for the fund’s investment manager who oversees the fund. Generally ranging from 0.50% to 1.0% annually.

- Marketing Fees: also referred to as a 12b-1 fee. These are fees for marketing and advertising of the fund. Annual fee that can range from 0.25% to 1.0%.

- Administrative Fees: the funds expenses for record keeping and other admin fees. Fees range 0.05% to 0.40% annually.

- Commission Trading Cost: commissions paid to the broker or agent to execute the trade.

- Mark up or Spread: the mark up, or the spread, is the difference between what the broker paid for the bond and what the broker is selling it for.

- Advisor Fees: these are the investment advisor charges individuals for managing the portfolio. Typically, the annual fee is between 1.0% and 2.0% of the assets under management.

The first step in reducing fees is to understand what your investments are truly costing you. If you’re comfortable with these fees, fine, there isn’t much for you to do. If you’re not, then you should find investments that align to your overall financial goals. There are investments out there that don’t have excessive hidden fees.

If you need help understanding what you’re currently paying in fees and would like to eliminate the ones that you can, feel free to contact us for a no-obligation appointment. Look at it this way, the less you pay in fees, the more you keep!